Cash-Secured Puts vs Credit Spreads: Which Premium Selling Strategy is Right for You?

Understanding Premium Selling Strategies

Premium selling has become one of the most popular approaches to options trading, and for good reason. While directional traders attempt to predict market movements, premium sellers work with probability and time decay on their side. The strategy is straightforward: sell options contracts, collect premium upfront, and profit when those contracts expire worthless or lose value.

However, choosing between different premium selling strategies can be confusing for traders at any experience level. Two of the most common approaches - cash-secured puts and credit spreads - each offer distinct advantages and trade-offs. Understanding these differences is crucial for building a strategy that aligns with your capital, risk tolerance, and market outlook.

This guide breaks down both strategies in depth, comparing capital requirements, risk profiles, profit potential, and ideal market conditions to help you make informed decisions about which approach fits your trading goals.

What is a Cash-Secured Put?

A cash-secured put is a straightforward premium selling strategy where you sell a put option while holding enough cash in your account to purchase 100 shares of the underlying stock at the strike price if assigned.

How Cash-Secured Puts Work

When you sell a cash-secured put, you're making a commitment: if the stock price falls below your chosen strike price by expiration, you're obligated to buy 100 shares at that strike. In exchange for taking on this obligation, you receive premium upfront.

Example mechanics: If a stock trades at $50 and you sell the $45 put for $1.00 premium, you collect $100 immediately (1 contract = 100 shares × $1.00). If the stock stays above $45 at expiration, the option expires worthless and you keep the entire premium. If the stock drops below $45, you're assigned and must purchase 100 shares at $45 per share, regardless of the current market price.

The Cash-Secured Requirement

The "cash-secured" aspect means you must have $4,500 in your account for the example above - enough to buy 100 shares at the $45 strike. This capital sits reserved until the position closes, either through expiration, assignment, or early closure.

Profit and Loss Profile

Maximum profit: Limited to the premium collected. Using the example above, your max profit is $100 regardless of how high the stock climbs.

Maximum loss: Substantial but defined. If the stock drops to zero, you'd lose $4,400 ($4,500 purchase obligation minus $100 premium collected). In practice, losses typically occur when the stock drops significantly below your strike.

Breakeven: Strike price minus premium collected. In the example, breakeven is $44 ($45 strike - $1.00 premium).

What is a Credit Spread?

A credit spread (specifically a put credit spread for premium sellers) involves simultaneously selling a put option at one strike while buying a put option at a lower strike. This creates a defined risk position with lower capital requirements than a cash-secured put.

How Credit Spreads Work

Credit spreads limit both your profit potential and your risk by adding a "protective" long put below your short put. This long put acts as insurance, capping your maximum loss.

Example mechanics: Using the same $50 stock, you might sell the $45 put for $1.00 and simultaneously buy the $42 put for $0.40. Your net credit is $60 ($100 collected - $40 paid). The spread width is $3 ($45 - $42 = $3 or $300 per contract).

Capital Requirements

Instead of securing the full $4,500 for a cash-secured put, a credit spread only requires capital equal to the spread width minus the credit received. In the example: $300 (spread width) - $60 (credit) = $240 in required capital.

Profit and Loss Profile

Maximum profit: Limited to the net credit received ($60 in the example). This occurs when both options expire worthless (stock stays above $45).

Maximum loss: Defined and limited. It equals spread width minus credit received: $300 - $60 = $240. This loss occurs if the stock drops below $42 at expiration.

Breakeven: Short strike minus net credit. In the example: $45 - $0.60 = $44.40.

Direct Comparison: Capital Requirements

The most immediate difference between these strategies is the capital required to enter a position.

Cash-Secured Puts: High Capital Demand

For cash-secured puts, capital requirements scale directly with stock price. Selling puts on a $100 stock requires roughly double the capital of a $50 stock. This can be prohibitive for smaller accounts or when trying to diversify across multiple positions.

Capital efficiency considerations: While the capital requirement is high, you're not losing this money - it's simply reserved. Many traders view this as acceptable since they'd be willing to own the stock at that price anyway.

Credit Spreads: Capital Efficient

Credit spreads dramatically reduce capital requirements by defining maximum risk upfront. You can often run 5-10 credit spreads for the same capital required for a single cash-secured put.

Scaling possibilities: Lower capital requirements mean you can diversify across more underlyings, spread risk across sectors, and scale position sizes more precisely to your account size.

Account Size Implications

Small accounts ($5,000-$10,000): Credit spreads are often the only practical choice, as cash-secured puts would limit you to 1-2 positions maximum.

Medium accounts ($10,000-$50,000): Both strategies become viable. You might run 2-3 cash-secured puts or 10-15 credit spreads with similar capital allocation.

Large accounts ($50,000+): Both strategies work well. The choice becomes more about strategy preference than capital constraints.

Risk Profile Comparison

Understanding how each strategy behaves under different market conditions is crucial for matching the right approach to your risk tolerance.

Cash-Secured Puts: Unlimited Downside to Zero

While technically defined (stock can only go to zero), the risk in cash-secured puts feels "unlimited" from a practical standpoint. A stock dropping from $50 to $30 creates significant unrealized losses even before assignment.

Assignment reality: When assigned, you own the stock at your strike price. If the stock continues falling, you're experiencing real losses on a stock position, not just an options position. This requires a different mindset and often more active management.

Recovery strategies: Many traders defend cash-secured puts by selling covered calls after assignment, effectively running the "wheel strategy." This can work well but requires patience and additional capital management.

Credit Spreads: Defined Maximum Loss

The protective long put in a credit spread caps your maximum loss at a known amount before entering the trade. This defined risk eliminates the possibility of catastrophic losses and makes position sizing more mathematical.

Sleep-at-night factor: Knowing your maximum loss before entering removes significant psychological stress. You can't wake up to a 50% account drawdown from a single position - your loss is capped at the spread width minus credit.

Black swan protection: During market crashes or individual stock disasters, credit spreads automatically limit damage. Cash-secured puts can lead to devastating losses during these events.

Profit Potential Analysis

Premium collection is why traders choose these strategies, but the profit mechanics differ significantly.

Cash-Secured Puts: Higher Absolute Premium

Selling naked puts (cash-secured) collects the full premium of the short put with no offsetting cost. On percentage terms relative to capital at risk, returns are typically lower than credit spreads, but absolute dollar amounts are higher.

Example: Selling a $45 put for $1.00 on $4,500 capital represents 2.2% return if successful ($100 profit / $4,500 capital).

Compounding consideration: While individual returns appear modest, successful cash-secured put sellers often achieve 12-24% annual returns by repeating the strategy consistently across multiple expirations.

Credit Spreads: Higher Return on Capital

Credit spreads typically achieve higher percentage returns on capital deployed, though absolute dollar profits are smaller.

Example: The $45/$42 credit spread collecting $60 on $240 capital represents 25% return if successful ($60 profit / $240 capital).

The efficiency trade-off: Higher percentage returns come with trade-offs. You're capping profit potential by buying the protective put, and you'll hit maximum loss more frequently since the loss zone is narrower.

Win Rate Considerations

Cash-secured puts typically have higher probability of profit because they only lose if assigned. Credit spreads can hit maximum loss without assignment if the stock drops below the long put strike.

However, credit spreads allow you to lose smaller amounts more frequently while maintaining overall profitability through superior position sizing and diversification.

Market Condition Suitability

Different market environments favor different strategies.

Cash-Secured Puts Excel In:

Moderately bullish markets: When you have strong conviction about downside protection but want to participate if the stock is assigned and rallies.

Low volatility environments: When implied volatility is compressed and you're willing to accept lower premium in exchange for potential stock ownership at discounted prices.

Quality stock selection: When you've identified stocks you genuinely want to own long-term at specific prices. The strategy becomes a patient way to enter positions while collecting income.

Dividend-paying stocks: Owning the underlying after assignment means collecting dividends, which can enhance overall returns significantly over time.

Credit Spreads Excel In:

High volatility markets: When IV is elevated and premiums are fat, you can collect meaningful credits even after paying for the protective put.

Neutral to bullish bias: When you want to profit from time decay without taking on full assignment risk of owning the stock.

Diversification needs: When you want exposure to multiple underlyings but have limited capital, allowing you to spread risk across sectors.

Defined risk requirements: When account management, margin rules, or personal risk tolerance demands knowing maximum loss before entering.

Assignment and Management Differences

How you manage these positions and what happens at expiration differs considerably.

Cash-Secured Put Management

Before expiration: You can close the position anytime by buying back the put. If the put has lost value, you profit. If it gained value (stock dropped), you can take a loss to avoid assignment.

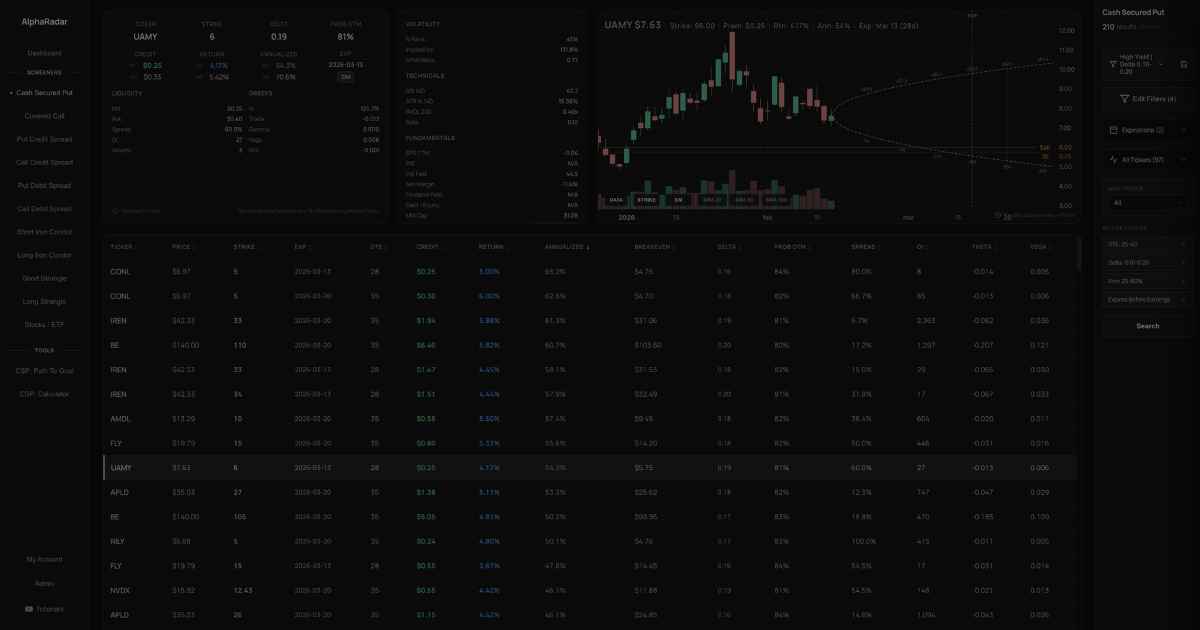

Supercharge your trading with AlphaRadar

Want to find the best options? AlphaRadar scans thousands of contracts for you.

At expiration: If the stock is above your strike, the put expires worthless and you keep all premium. If below, you're assigned 100 shares at the strike price.

After assignment: You now own stock and must decide whether to hold long-term, sell immediately, or begin selling covered calls against the position.

Rolling opportunities: You can roll threatened positions by buying back the current put and selling a new put at a later expiration, collecting additional credit while giving the trade more time.

Credit Spread Management

Before expiration: You can close by buying back both legs simultaneously. Your profit or loss depends on how the spread price has changed since entry.

At expiration: If the stock stays above the short strike, both options expire worthless and you keep the full credit. If it drops between strikes, you're assigned on the short put but can exercise the long put to close the position.

Maximum loss scenarios: If the stock drops below the long strike, you're at maximum loss. Both options expire in-the-money and the position settles for the maximum loss amount.

Rolling credit spreads: More complex than cash-secured puts because you're managing two legs. You can roll the entire spread out in time or adjust strikes, but transaction costs and bid-ask spreads impact efficiency.

Position Sizing Guidelines

Proper position sizing prevents any single trade from creating unacceptable account damage.

Cash-Secured Puts Sizing

A common approach is limiting any single cash-secured put to 5-10% of account value. With a $50,000 account, this means each position risks $2,500-$5,000, limiting you to roughly 10-20 positions maximum if fully deployed.

Concentration risk: Because capital requirements are high, it's easy to become over-concentrated in just a few underlyings. This creates correlation risk if your chosen stocks are in similar sectors.

Credit Spreads Sizing

With defined maximum loss, position sizing becomes more precise. Many traders risk 1-2% of account value per trade. A $50,000 account risking 1% means $500 maximum loss per position, allowing for significantly more positions.

Diversification benefits: Lower capital per trade enables true diversification across 20-30+ underlyings, reducing correlation risk and smoothing returns.

Balancing Both Approaches

Advanced traders often run both strategies simultaneously - cash-secured puts on high-conviction stocks they want to own, and credit spreads for additional income generation and diversification.

Tax and Accounting Considerations

Tax treatment differs slightly between strategies.

Cash-Secured Puts

Premium collected is not taxed until the position closes. If assigned, the premium collected reduces your cost basis in the acquired shares. If the put expires worthless, the premium is short-term capital gain.

Assignment accounting: When assigned, your cost basis becomes strike price minus premium collected. Any subsequent sale of shares determines capital gains treatment (short or long-term based on holding period).

Credit Spreads

Net credit collected is taxed when the position closes. These are typically short-term capital gains if held less than one year, which applies to most premium selling strategies.

Spread settlement: At expiration, the entire spread settles as a single transaction for tax purposes, simplifying record-keeping compared to managing assignment and subsequent stock sales.

Common Mistakes to Avoid

Cash-Secured Put Pitfalls

Selling puts on stocks you don't actually want to own: This defeats the purpose of the strategy. Only sell puts at strikes where you'd be happy owning the stock.

Ignoring overall market risk: Cash-secured puts can lead to 100% long stock exposure across your entire portfolio during market crashes if multiple positions get assigned simultaneously.

Chasing premium in high IV without reason: Elevated IV often signals elevated risk. Getting assigned on a stock that drops 40% means your premium collection was inadequate compensation.

Credit Spread Pitfalls

Making spreads too narrow: Ultra-tight spreads (like $1 wide) create poor risk-reward ratios. The bid-ask spread and commissions eat into already small profits.

Trading illiquid underlyings: Wide bid-ask spreads on both legs can make entry and exit expensive, turning theoretical profits into real losses.

Letting spreads go to expiration at maximum loss: Unlike cash-secured puts where assignment might be acceptable, credit spreads at max loss should usually be closed early to avoid pin risk and free up capital.

Psychological Factors

Beyond mathematics, your personality and trading psychology matter.

Cash-Secured Puts Require:

Patience with assignment: Being comfortable holding stocks through volatility and drawdowns if assigned.

Long-term mindset: Viewing assignment not as failure but as successful entry into a stock you wanted to own.

Capital patience: Accepting that large amounts of capital sit reserved and "idle" while securing puts.

Credit Spreads Require:

Acceptance of defined losses: Being comfortable taking small losses frequently while the math works out over many trades.

Active management: More positions mean more monitoring, adjustments, and decision-making.

Trust in probability: Understanding that losing trades are normal and expected within a profitable system.

Decision Framework: Which Strategy Should You Choose?

Choose Cash-Secured Puts If:

You have adequate capital ($25,000+)

You want to build long-term stock positions at specific prices

You prefer fewer positions with higher individual capital allocation

You're comfortable with assignment and managing stock positions

You trade high-quality stocks you'd hold long-term

You want to run the wheel strategy after assignment

Choose Credit Spreads If:

You have limited capital (under $25,000)

You want defined risk on every trade

You prefer diversification across many positions

You want higher return on capital deployed

You trade in high IV environments regularly

You're building pure premium selling income without wanting stock ownership

Consider Using Both If:

You have medium to large account size ($50,000+)

You want to balance stock ownership with pure premium collection

You can manage the complexity of running multiple strategy types

You want to optimize for different market conditions with different tools

Conclusion: Building Your Premium Selling Approach

Both cash-secured puts and credit spreads represent powerful tools in the premium seller's arsenal. Neither is universally superior - each excels in specific situations based on your capital, goals, and market conditions.

The key to long-term success isn't choosing one strategy exclusively, but rather understanding when each approach provides optimal risk-reward for your specific situation. Small account traders often begin with credit spreads due to capital efficiency, then gradually incorporate cash-secured puts as account size grows and they identify stocks worth owning.

Experienced traders frequently run both simultaneously - using cash-secured puts for high-conviction entries on quality stocks while running credit spreads for additional income generation and diversification.

Regardless of which path you choose, success in premium selling comes from consistent application of probability-based decision making, proper position sizing, and disciplined risk management. The strategy you select matters less than how consistently and intelligently you execute it over time.

Start with the approach that matches your current capital and comfort level, master it through repetition, then consider expanding your toolkit as your experience and account size grow. Premium selling rewards patience, discipline, and mathematical thinking - qualities that translate to success regardless of which specific strategy you deploy.

Stop Hunting for Trades. Start Screening with AlphaRadar

Multi-strategy options screener. Advanced filtering. Integrated technical analysis.